Summary

The study examines how female consumers shop for home textile products online that are perceived by many as difficult and / or complex to buy. The report reports on the results of eye tracking and interviews with the aim of understanding whether customers feel they have all the information they need to be able to complete a purchase of curtains through e-commerce. The female respondents were aged 19-57, which is considered to represent the clearest target group in the home textile market.

Test Method

The tests were conducted during the month of February 2014 and the study was conducted on a total of 36 respondents, all women aged 19-57. The respondents were instructed to visit a predetermined website to complete a purchase of curtains. Hemtex.se was one of the predetermined websites that a selected part of the respondents were allowed to visit. The other online store was an online player that prefers to be anonymous. The respondents were encouraged to act exactly as they would have done at home in a natural environment if they were to make an e-commerce purchase. 19 of the respondents were studied through both eye tracking and interviews, the remaining respondents completed the e-commerce purchase where they were filmed and interviewed.

Results/Conclusion

The most important results that have emerged regarding women’s consumption of home furnishings online are:

- There is a trend in which brands / players are interesting to customers depending on whether they shop their home textiles / home furnishings online or in a physical store. In terms of consumption in physical stores, Hemtex, together with IKEA and Åhlens, is a player that the majority of respondents visit and shop at. When questions are asked about e-commerce, the answer options are significantly more. The respondents ‘answers indicate that there is a gap in the physical stores’ ability to catch customers in their online shops.

- Results about the target group’s preferences and interests show that the majority of the respondents are interested in home furnishings and about half of the study’s respondents buy home furnishings with a frequency of 6-12 times per year. However, curtains are not assumed to be a priority purchase when customers want to freshen up the home with new furnishings. A majority of respondents buy curtains less than once a year.

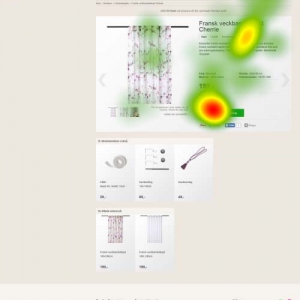

- At one of the online stores that were used as “test stores” there was a guide for “everything for your curtain set” but few of the respondents saw the guide and even earlier chose to use the guide. In terms of the respondents who visited this particular online store, approximately 17% of the respondents felt unsure about whether they had all the materials they needed to set up their curtains at home. This indicates that the service offered in the decision phase regarding curtain purchases does not reach the e-shopping consumer. It would have been interesting to carry out tests that involved an actual implementation of purchases to see if the customers who felt they had everything that was needed actually had it or if there is a knowledge gap in the customer about what he thinks he needs and what is actually needed. In addition to the above results, which are linked to the purchase of home textiles and curtains in an e-commerce situation, general conclusions have also been drawn. An important reflection that should be studied in more detail is:

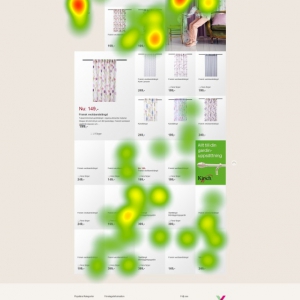

- Eye tracking results clearly show that very few customers look at the “We also recommend” products, a function where the company shows accessories or related products, among other things. The customer’s lack of interest in these products is in turn assumed to have a negative effect on sales of joint purchases, spontaneous purchases or additional sales online.